CPC rates are declining

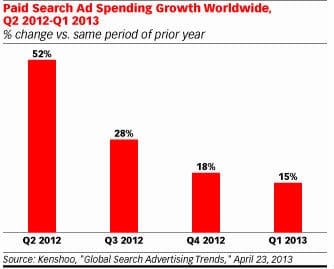

Global paid search ad spending continues to rise, with year-over-year growth in Q1 2013 reaching 15%, according to Kenshoo’s “Global Search Advertising Trends” report. In the US, year-over-year growth reached 24%.

Much of that increased search ad spending is going toward mobile devices, as consumers do an increasing percentage of their browsing and research on smartphones and tablets. But search advertisers, especially in the US, still put a premium on desktop search.

Kenshoo found that in the US, the allocation of paid search ad spending across devices is not keeping up with the distribution of clicks. In Q1 2013, the tablet and phone accounted for nearly 20% of paid search clicks, but the devices only garnered about 14% of search spending. The biggest lag was on the phone, which accounted for about 9% of clicks but only 5% of total spend.

In the UK, by comparison, there is a much narrower gap between mobile spend and clicks: Mobile devices get 28% of clicks and 25% of spend.

In terms of cost-per-click (CPC) rates, globally prices are trending downward, and that is especially true in the US. In Q1 2013, the average US CPC was 38 cents, down from a one-year high of approximately 47 cents in Q3 2012.

The computer still garnered the highest CPC rates in the US, at 56 cents in Q1 2013, while the phone was a comparatively inexpensive 30 cents per click, and tablet paid search clicks were right in the middle, at 46 cents.

eMarketer expects total US search spending to reach nearly $20 billion this year and top $25 billion in 2017. Mobile search spending tripled last year, according to eMarketer, and is expected to increase another 80% this year, to reach $3.6 billion. By 2017, more than half of search spending will go toward mobile formats.